- The loan form of

- Their credit reputation

- Your loan purpose (family pick otherwise re-finance)

A smart idea to speed up this action when what is an ibv check you are trying to find a separate house is to track down home financing preapproval. Very, by the time you can see the house, you understand that one can rely on the loan.

Always, more advanced a mortgage try, more date it will require to close off they. Eg, Government Property Administration, called FHA money, takes to two months to close. This type of funds need comprehensive documents review and a lot more records form more day.

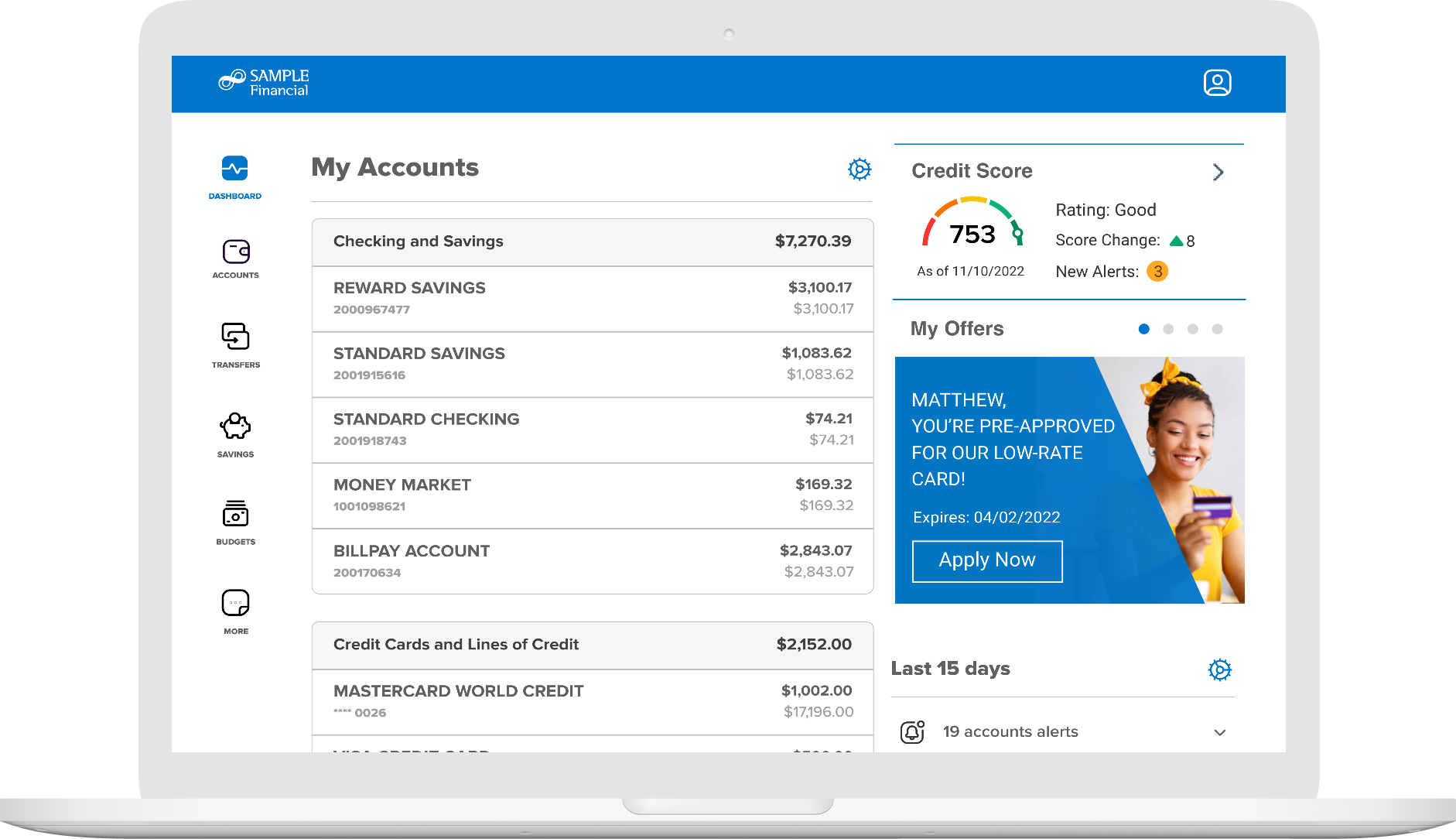

Your credit rating influences almost any sort of loan you should score. This score is comparable to your credit report. It suggests potential lenders just how reliable a debtor youre. The greater the financing, the greater amount of dependable youre to own lenders, so you are more inclined to pay the loan. Good credit increases your chances of getting accepted having home financing less.

A high credit rating enables you to rating a lower focus rates. It means might pay smaller when you look at the monthly financial pricing. Conversely, a woeful credit score will boost your interest levels.

Its demanded to not sign up for the latest borrowing once you know we would like to get a mortgage. This new funds is also adversely perception your credit rating. Along with, it’s a good idea to check your credit score before you look to have a home loan to see how well you’re starting.

Our home advance payment is the amount of money you prefer to store prior to purchasing a separate household. This is basically the currency you really must be in a position to provide on your own. Others could be covered by your own bank as soon as your financial software program is acknowledged. Every loan providers estimate the brand new downpayment given that a portion of the cost of the property you want into the to find. An average down-payment are 20% of your own home’s speed.

Although not, remember that this is simply not a company important. While most lenders ask for a great 20% downpayment, there are software where you can only pay doing 3%. Eg, having an effective U.S. Federal Houses Administration (FHA) financing, you merely need lay out step three.5% of your own value of your future home.

- The ability to get approved to have home financing reduced;

- The capacity to pay back the mortgage sooner;

- Straight down monthly mortgage repayments.

These types of insurance rates handles your own lender for folks who be incapable to blow straight back the loan. The expense of that it insurance policy is always covered by this new borrower. There are specific circumstances if this insurance policies is necessary.

Credit ratings are determined based on each person’s credit history

If you possibly could build an advance payment with a minimum of 20% or even more of one’s home’s price, you’re not necessary to afford the financial insurance. not, for individuals who spend less than the standard 20%, you will also have to order mortgage insurance coverage.

The lender often evaluate your position and you may pre-accept the loan

This is because you place your own lender during the higher risk as they need protection a larger number of this new property’s value. There are also certain types of mortgages, particularly FHA mortgage loans, you to definitely automatically incorporate mortgage insurance coverage, regardless of how much you put off due to the fact an upfront commission.

The answer was yes. There are some variety of mortgage loans that will be specifically made having first-go out home buyers. A few of the most well-known choices tend to be:

- FHA loans

- Federal national mortgage association and you may Freddie Mac computer loans

- USDA loans

- Va fund