Currency in hand, when it’s needed extremely. It sounds too good to be real, however it is legit! Property Security Line of credit (HELOC) makes you borrow very little otherwise up to your need, to cover life’s planned or unanticipated costs. So you’re able to qualify you should very own property and then take equity from your own your house.

HELOC Pricing

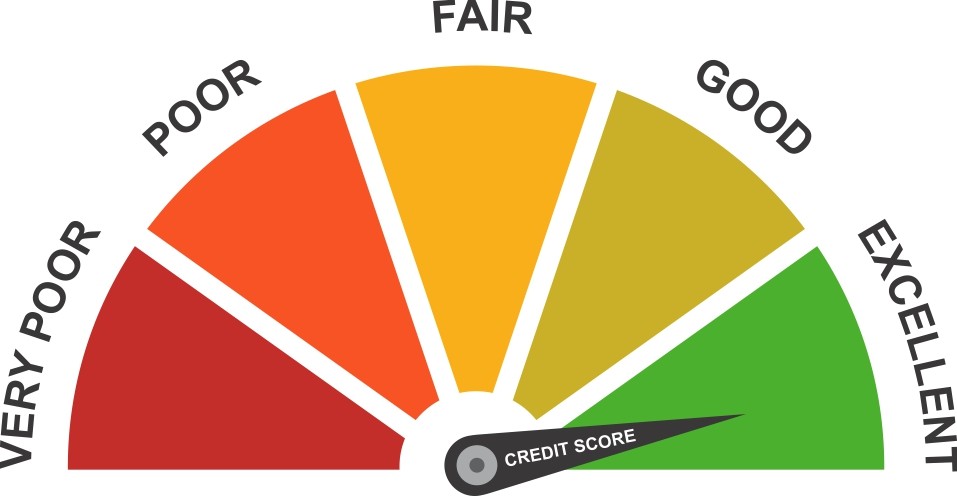

1 Apr = Annual percentage rate. Brand new showed Apr signifies a minimal you are able to pricing available. Cost are derived from credit score and generally are susceptible to alter without warning.

step 1 Annual percentage rate = Annual percentage rate. The newest demonstrated Apr signifies a low you’ll be able to prices readily available. Pricing depend on credit rating and tend to be subject to changes without notice.

Begin their HELOC software here:

Apr = Apr. The latest basic Apr is fixed for just one year (a year). Adopting the next 12 months, new Annual percentage rate was changeable according to the You.S. Prime Speed while the blogged regarding Wall structure Path Log, and additionally good margin. To get a basic price, borrower must meet credit and you can mortgage program criteria, and ( not limited to): 1) limitation Mutual Loan-to-Worth (CLTV) as much as 80% (to possess Biggest Professionals Only with credit history regarding 600 or more), 2). debtor have to have automatic transmits off a beneficial Finex CU family savings into monthly HELOC costs, 3) borrower shouldn’t have acquired an earlier basic price having an excellent Finex CU HELOC within the last 36 months, and you can, 4) Established Finex Credit HELOC’s commonly eligible for campaign until a the fresh range was removed within $25,000 over the original range. Particular limits affect present lines of credit that have Finex CU. 5) Marketing and advertising discount was associated with players who have been into the a standing getting ninety days and you can a relationship account and therefore we explain once the Cashback, Cashback In addition to, or High-Rate Family savings proprietors along with $500 minimal direct deposit/month. Minimum loan amount out-of $twenty-five,000 and you can a total of $250,000. The fresh basic speed applies to the latest changeable line being used only and is not appropriate to any Fixed-Rates Mortgage Solution. Homeowners insurance is needed. Closing costs could well be waived yet not, if the mortgage was paid down within the first two age of the closure date, you will refund the financing Commitment to have quantity reduced on the behalf. Selling terminology work well to your software acquired regarding 10/1/2024 in order to .

The latest Annual percentage rate are variable in line https://paydayloanalabama.com/southside/ with the You.S. Primary Rates as the had written in the Wall surface Highway Diary, along with a great margin (in the event the appropriate). The minimum flooring Annual percentage rate are cuatro.00%. HELOCs is actually variable price services costs might not exceed the fresh restrict courtroom limitation getting Federal credit unions (already 18%). The prime Price as of nine/ = 8.00%.

Costs and you can terminology is susceptible to alter without warning. All the now offers out-of credit is actually subject to borrowing from the bank acceptance requirements and individuals could be provided borrowing on higher rates or any other words. Loan-to-Really worth (LTV) and/or Combined LTV (CLTV) limits implement. Threat insurance is called for to your every money covered by the real property (flooding insurance can be expected in which appropriate). Pricing shown are based on a beneficial borrower’s step one-cuatro relatives no. 1 home, a max CLTV out-of 80%, should be an initial or next lien, and you will automatic transfers out of a great Finex CU family savings. Demand a taxation elite concerning your prospective deductibility interesting. Matchmaking membership in the Finex CU becomes necessary. Standard registration otherwise the fresh new people should begin lowest Lead Put out of $500/month and you may need debit credit twelve purchases/times. Must be productive having ninety days and you will account craft must be examined of the loan manager to receive discount price.