USDA Home loans are no deposit funds which have straight down financial rates than Conventiona Finance. Two of the big USDA Financial Qualifying Conditions is you to definitely the property be located within from inside the an excellent designated USDA Financial town as well as the domestic money must not go beyond this new limits below. USDA Financial Income Restrictions Improvement in 2024, plus 2023, our company is currently by using these large loan constraints since . Into the Northern Caroina these have become great expands for every state throughout the State.

About three Particular USDA Mortgage brokers Available in NC

Get ready to help you plunge to the realm of USDA mortgage brokers, where options try due to the fact bright as your fantasies! Regardless if you are aiming for a cozy home otherwise a nice-looking room, USDA’s had the back. Take a look at the extremely options that can make your home sweet household excursion super easy.

First up, we the fresh Single-Relatives Direct Mortgage the ultimate winner to own lower- and also-low-earnings superheroes. USDA’s had debt cape protected, with full resource, services, and you may insurance rates. You’re able to select nothing, however, a few repayment solutions brand new 33-seasons plus the 38-seasons preparations. Your revenue peak, your own phone call! This type of loans are only offered Straight from your neighborhood USDA Offices, you cannot buy them away from Banking institutions otherwise Agents.

Effect the newest moderate-earnings vibes? Say good morning into Solitary-Family relations Guaranteed Financing! We are able to help you with this type of USDA Home loans, whenever you are USDA contributes you to extra coating of security against default. Because they are backed by USDA, the mortgage rates of interest of these loans and the full monthly costs of these finance is leaner than just there’ll be having an effective traditiona Traditional financing or a FHA Mortgage loan. Independence is the name of one’s video game, that have fifteen-seasons and you can 30-12 months repaired-rates options. Your ideal family just got so much nearer!

But wait, there is even more! Opening the brand new Solitary-Family unit members Casing Resolve Financing your own admission in order to turning your existing pad to your a paradise. We’re talking modernizing, improving, and you can waving goodbye to those safety perils. The mortgage number? It is all about that Since https://paydayloanalabama.com/parrish/ the Enhanced urban area. And you may do you know what? You can also liven up the kitchen on the new home you happen to be eyeing. Got low-structural solutions significantly less than $35,000 in your thoughts? You will be ready to go having a good USDA Recovery Mortgage! Need certainly to tackle some bigger fixes, like a bright the newest roof? Provided element of those funds try going for the structural things, think about it sorted.

Now, let us speak quantity. USDA funds is the wallet’s best friend. No downpayment needed sure, you understand you to definitely best! Bid farewell to those people annoying conventional and you may FHA loan laws and regulations. Also, the month-to-month home loan insurance coverage rates? A great teeny-tiny .4%. That’s not even half the cost of the individuals FHA costs. And you will here’s the scoop: no sly prepayment penalties or hidden charges. It’s all regarding the openness and you will making your daily life easier.

Okay, ok, we all know you have questions about qualification. Worry not, due to the fact USDA fund are only concerned with ease. Yes, they have their demands, however, they aren’t too difficult. USDA Home loan Money Limits Improvement in 2024 inside NC the best part would be the fact we could have fun with the individuals Higher loan count as of ! The major professionals listed here are your revenue along with your property. While you are within the sync that have the individuals, you might be golden.

Income limitations, you ask? We now have ’em to you. For every single Condition keeps a different sort of limitation but also for Most of NC, $110,650 for 1-cuatro people in the house, and you can $146,050 having a team of five-8. Got more than 8 some body? For every single extra representative will get an awesome 8% cut of 4-person money limit. It is like divvying within the victory pie!

Here are a few situations that are easy to see

- USDA 100% Mortgage brokers inside NC render Renovation Fund

- USDA 100% Home loans within the NC was 29 year repaired price mortgage loans

- USDA 100% Lenders in NC have quite aggressive rates

- USDA 100% Home loans for the NC are to possess Manager Filled Qualities

- USDA 100% Financial Financial support doesn’t have pre-payment charges

- USDA 100% Mortgage Investment does not require a deposit

- USDA 100% Financial Money demands an incredibly reduced month-to-month mortgage insurance rates (particularly when you evaluate it so you’re able to Conventional Fund otherwise FHA Financing)

USDA Home loan NC Money Limits By Condition / MSA

USDA Home loan Income Limits Change in 2024 is excellent news for families when you look at the NC who would like to have the ability to pay for a little larger household! USDA Financial Income Restrictions Improvement in 2024, luckily for us that we normally follow these changes Today. Definition we can use these large earnings limitations for the that’s a giant work for to have customers into the NC! Not absolutely all loan providers are utilising such large Income Limitations now, another reason to mention all of us now! 919 649 5058

What is actually A great MSA?

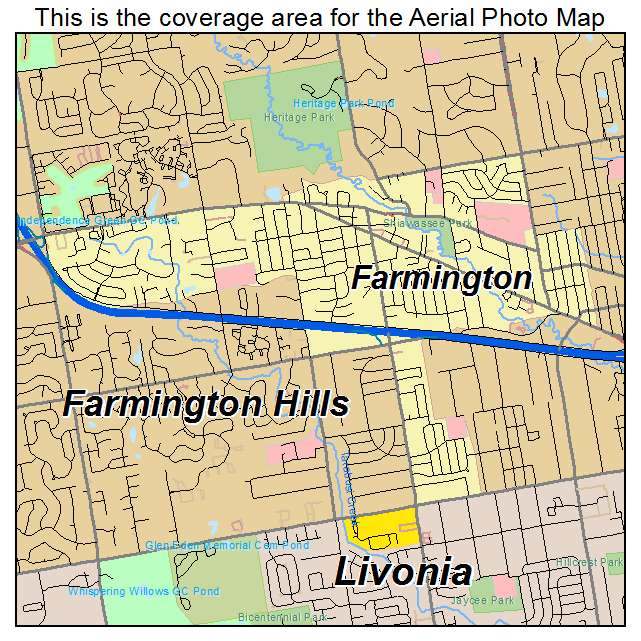

Metropolitan Mathematical Area (MSA): A location which have a minumum of one urbanized area of fifty,000 or more people, along with surrounding region that a high level of social and you may monetary consolidation with the key, since the mentioned of the travelling links. During the otherwords, in NC good MSA are an excellent Location city, and it’s also put when there is certainly a Suburb urban area in order to a Region. Higher exemplory instance of which is Harnett State. I do not think we create thought Harnett County a metropolitan Area but not, its romantic enough to Raleigh and you can Fayetteville it is perhaps not remote particularly various other outlying parts into the NC. Because of that, you will find a discreet difference between the brand new chart to own Harnett State for USDA Home loans.

Brand new USDA Financial Income Limitations Change in 2024 is very good news having families into the NC who wish to have the ability to pay for a little larger home!If you are considering a good USDA Financial within the Vermont, excite telephone call Steve and you will Eleanor Thorne 919 649 5058. The audience is experts with respect to this choice, we aided tens of thousands of consumers get properties from inside the NC for the USDA Financial System, and now we would love to make it easier to as well!!