An overview of House Depot Financing

Our home Depot Organization offers lucrative money options to the customers. People to shop for tools, gizmos, and you can do-it-yourself activities may use funding selection given by Home Depot.

It is a convenient way for people because they do not must sign up for third-cluster financing. Domestic Depot even offers financing the help of its flagship individual and you will investment credit notes that have varying loan terms.

The loan app techniques is easy and you will users can apply on the web otherwise by going to a store. The program approval conditions, rates, and other standards are different to the various points (chatted about lower http://paydayloancolorado.net/four-square-mile than).

Family Depot Bank card

Citi bank. Although not, in lieu of other playing cards, they could just be utilized for shopping during the Domestic Depot stores and you will net websites.

This bank card has the benefit of 0% interest rates in the event the users pay off the full number within this six months. But not, you are going to need to shell out accumulated notice when you yourself have one remaining harmony adopting the advertising and marketing period.

- 0% attract if reduced in this 6 months of one’s marketing months on the commands from $299 or even more.

- Varying Annual percentage rate to have basic installment words off -%.

- Late Fee payment from $forty.

- Up to twenty four-months out-of fees terminology depending on the borrowing from the bank matter.

- Zero annual costs.

Home Depot Project Mortgage Credit card

The home Depot endeavor financing is for people in search of larger renovations. Which loan is up to $55,100000 for your home restoration and you will update expenses.

Your panels loan bank card could also be used here at the house Depot areas having looking. Customers keeps up to 6 months to completely make use of the recognized loan amount.

- Is sold with a borrowing limit out of $55,one hundred thousand

- Zero annual commission

- Loan regards to 66-, 78-, 90-, and you may 114-weeks

- Fixed APRs of 7.42%, %, %, and you will % correspondingly to own terms and conditions mentioned above.

Home Depot Credit card App Procedure

Consumers can use on the web or from the Household Depot places to possess its preferred credit card. Your house Depot borrowing from the bank center product reviews applications and you will protects the mortgage techniques.

There is absolutely no prequalification stage during the Home Depot investment properties. It indicates there are a challenging borrowing inquiry once you get credit cards your house Depot.

The genuine criteria and the recognition process is based on of numerous things including your earnings, borrowing from the bank reputation, and you will early in the day background.

Home Depot Financing Rejected 5 Causes You should know

Even although you complete all the information and records criteria, there is absolutely no guarantee that your home Depot enterprise loan commonly become acknowledged.

Bad credit Score

The home Depot and its own resource mate have a tendency to evaluate your own borrowing rating like most other bank. There isn’t any regard to minimum credit rating specifications commercially no matter if.

not, if the credit history is actually bad, odds are the loan software is rejected. In case your almost every other testing metrics are vital, then you’ll you prefer an even higher credit score to progress that have a credit card applicatoin.

Red flags in your Credit score

Loan providers see your credit report to evaluate your own background. He’s constantly keener knowing how you paid off your early in the day loans.

When your credit history reveals later monthly premiums, delay costs, standard, or bankruptcies, your odds of loan approval is actually thin.

Your debt-to-Money try High

Your debt-to-earnings ratio reveals how much of one’s gross income is certian to your monthly financing repayments. It means whether it ratio try higher, you have a little pillow to suffice yet another financing. Like any other lender, House Depot may also be curious to see a lower life expectancy financial obligation-to-money ratio in your credit profile.

A primary reason for people financing rejection would be the fact your income tips are erratic. This means you don’t need to a secured otherwise long lasting income provider.

It may sound also noticeable however could have considering the fresh incorrect information about the loan software that will trigger a good getting rejected.

Eg, you may enter the specifics of good cosigner and you will fail. Likewise, any omission or problems on your own loan applications can lead to financing getting rejected too.

Ideas on how to Change your Approval Chances yourself Depot?

You could re-apply during the Home Depot for a new project loan or a consumer credit credit anytime. not, it can affect your credit rating since it runs into a difficult eliminate and you can reduces your credit score.

Choices so you can Family Depot Opportunity Loan

Reapplying at Domestic Depot for a venture loan can cost your credit score facts. You can look at several choices towards consumer credit card together with opportunity mortgage.

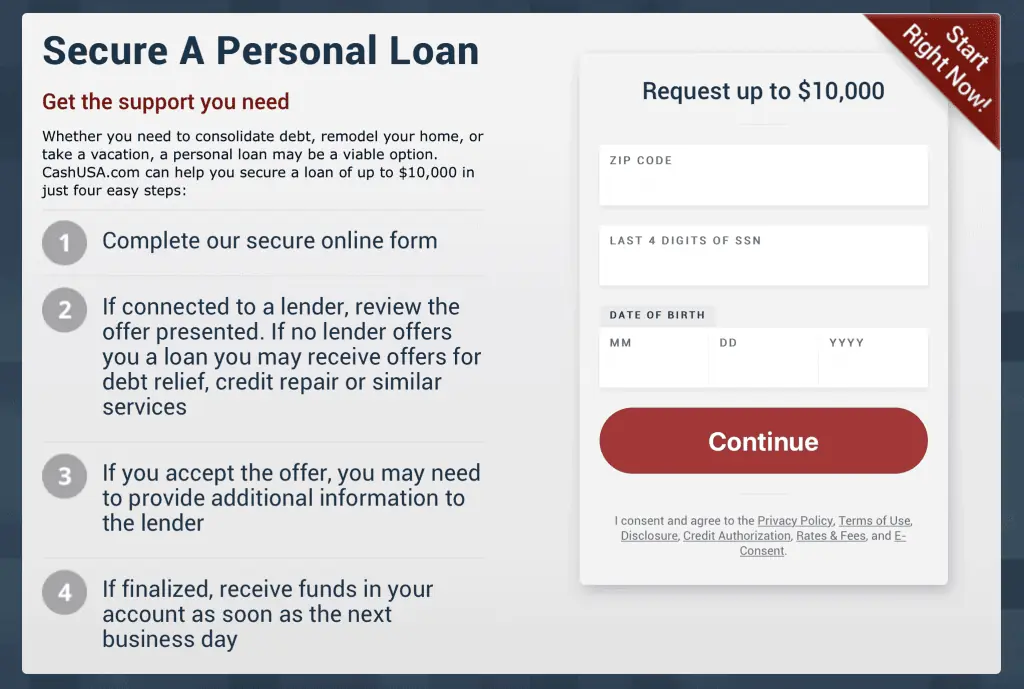

Imagine almost every other do-it-yourself loan given by a professional financial, credit connection, otherwise personal bank. Specific lenders take on loan requests with assorted approval standards.

You might capture a traditional method of loans your home advancements by applying to own a home personal line of credit or range off equity dependent on your position.

If you have based family guarantee, it can be used as a hope so you can secure a personal financing. You can use this approved personal bank loan for purpose in addition to your property update requirements.

Finally, when your latest financials don’t let having a new financing, you could refinance one of the current financing. You could potentially refinance a personal bank loan, a mortgage, or even credit card finance to produce a cushion for the home improvement requests.