Leveraging the power of automation for important business processes like accounting and finance improves business outcomes. There are 4 main types of financial statements that every business needs to prepare. The online survey was in the field from February 22 to March 5, 2024, and garnered responses from 1,363 participants representing the full range of regions, industries, company sizes, functional specialties, and tenures. Of those respondents, 981 said their organizations had adopted AI in at least one business function, and 878 said their organizations were regularly using gen AI in at least one function. To adjust for differences in response rates, the data are weighted by the contribution of each respondent’s nation to global GDP.

What is Accounting? Definition, Objectives, Advantages, Limitation, Process

It helps them make informed decisions about investing, lending, working, and supplying to a company. Investors and owners use this information to make decisions about investing in a company. They can see how profitable the company is, how much debt it has, and how much cash it generates. Accounting history dates back to ancient civilizations in Mesopotamia, Egypt, and Babylon.

Internal Auditing

Forensic accountants are the detectives of accountancy, spending their time looking into company files in search of white collar crimes like employment fraud or identity theft. These crimes are on the rise, and so forensic accountants are more likely than ever to take a look over your own company’s books. With all accounting software and data hosted on the cloud, an accountant can access everything they need by simply typing their password in a browser anywhere in the world.

Principles of Financial Accounting

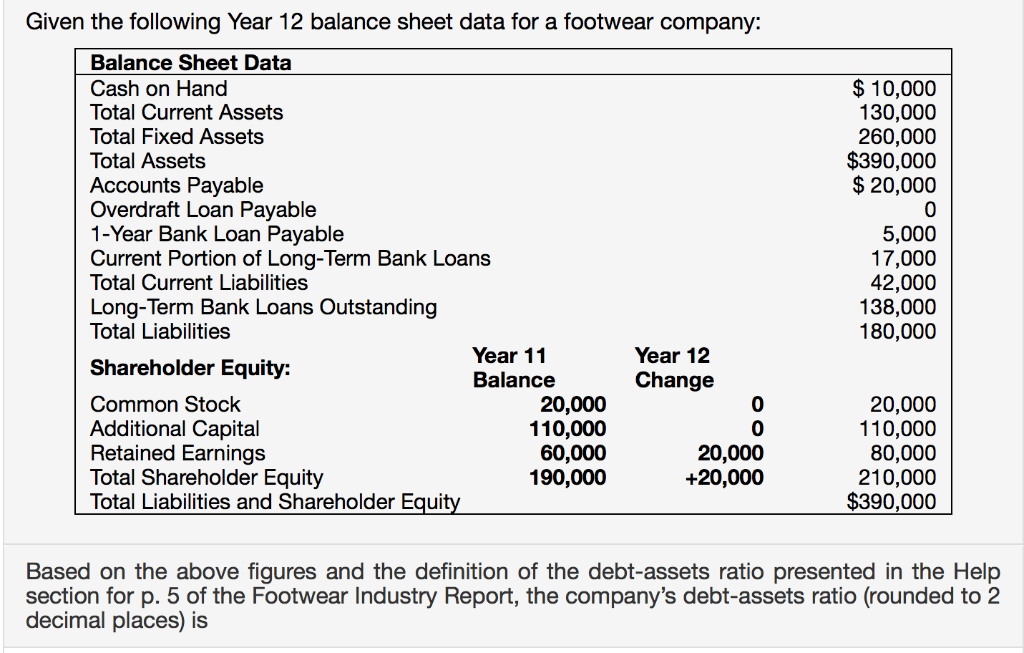

Assets of a company include cash, prepaid expenses, notes and accounts receivable, machinery and equipment, intangible assets, building and infrastructure, and vehicles. Liabilities can include accounts payable, notes payable, unearned revenue, deferred tax, current taxes, and mortgages. Accrual accounting is based on the matching principle, which is intended to match the timing of the realization of revenues and an expense.

Types of Accounting

Rapid requests for new systems and advisory support can be common and this often duplicates efforts already well-underway by the sustainability functions. Sustainability teams can help educate their accounting colleagues by providing a current state of sustainability reporting systems and procedures. This includes an end-to-end look at the process for greenhouse gas emissions calculations, materiality assessments, HR and safety data and other systems that feed sustainability reports. This will help onboard the accounting function to this type of non-financial data and provide insights for how to incorporate this information into SEC filings and other relevant disclosures. An income statement, also known as a “profit and loss statement,” reports a company’s operating activity during a specific period of time.

They provide information on a company’s revenues, expenses, assets, liabilities, and cash flows. A high degree of accuracy, consistency, and security is required to handle financial and https://www.business-accounting.net/earnings-vs-revenue/. Manual methods of financial accounting cannot provide the accuracy and consistency required in handling sensitive financial data.

- For example, you can track and approve invoice progress using some accounting software tools.

- We’ll also discuss issues of ethics in the accounting communities and career opportunities in the accounting profession.

- Accounting software allows you to do basic tasks such as tracking inventory, invoicing and payments, and generating reports on sales and expenses.

- By using accounting information, businesses can evaluate their financial performance, identify areas that need improvement, and make sound business decisions.

- Tracking business spending concerning income helps keep a tab of business costs and revenue.

- Mathematical skills are helpful but are less important than in previous generations due to the wide availability of computers and calculators.

Outsourcing can offer many advantages because it allows you to take advantage of specialized skill sets that may not be available when hiring someone in-house. Tax professionals include CPAs, attorneys, accountants, brokers, financial planners and more. Their primary job is to help clients with their taxes so they can avoid paying too much or too little in federal operating profit vs net income income or state income taxes. Accounting is like a powerful machine where you input raw data (figures) and get processed information (financial statements). The whole point is to give you an idea of what’s working and what’s not working so that you can fix it. These four largest accounting firms conduct audit, consulting, tax advisory, and other services.

This makes any data forecasting talent a huge part of an accounting team’s successful performance. To keep up with the pack, we recommend brushing up on the skill with the right online courses or initiatives. Still, one study found that as many as 76% of workers say they would actively start looking for a new position if their employer decided to roll back their existing flexible work options. That’s a high level of push-back, and it aligns with similar findings indicating that businesses without any remote work options available are having a harder time hiring.

The double entry system is based on scientific principles and is, therefore, used by most of business houses. The system recognizes the fact that every transaction has two aspects and records both aspects of each and every transaction. Financial scams and frauds in accounting practices have drawn attention of the users of the accounting information supplied by business enterprises. Even the well-governed multinational companies like Enron and other World companies have not escaped from the fraudulent accounting practices. Accounting methods are applied to evaluate the human resources in money terms so that the society might judge the total work of the business enterprises including, its non-human assets.

To determine which type of accountant you might need, we break down the eight most common types of accounting from tax and cost accounting to international and forensic accounting. Figure 12.3 “Management and Financial Accounting” summarizes the main differences between the users of management and financial accounting and the types of information issued by accountants in the two areas. In the rest of this chapter, we’ll learn how to prepare a set of financial statements and how to interpret them.

Organizations are already seeing material benefits from gen AI use, reporting both cost decreases and revenue jumps in the business units deploying the technology. The survey also provides insights into the kinds of risks presented by gen AI—most notably, inaccuracy—as well as the emerging practices of top performers to mitigate those challenges and capture value. If 2023 was the year the world discovered generative AI (gen AI), 2024 is the year organizations truly began using—and deriving business value from—this new technology. In the latest McKinsey Global Survey on AI, 65 percent of respondents report that their organizations are regularly using gen AI, nearly double the percentage from our previous survey just ten months ago.

When seeking out systems to store, track and analyze ESG data, no one provider yet has a true end-to-end solution. Organizations need to evaluate multiple tools and determine what will work https://www.online-accounting.net/ best for their own use cases. First, assess what systems are already in place and be clear on needs with the IT team before beginning a sourcing process for new technology and/or software.