One of the most popular complications with house appraisals inside mortgage procedure is when the appraiser shows up quick on appraised property value the purchase price of the property. This new appraised worth is considered the most common issue that have appraisals. When the appraised worthy of is leaner as compared to price or number had a need to over a beneficial refinance, consumers is actually upset.

As mentioned above, the next-party unbiased assessment covers both the lender together with debtor. Obviously, its difficult, as well as the borrower has gone out good chunk of cash, although it does protect them out of to shop for a valuable asset overvalued.

You can find requirements of the property that can be assessment situations. A keen appraised worth commonly sometimes get back as is or subject to repairs. An assessment differs than property inspection. But an enthusiastic appraiser often nonetheless see major inadequacies. One damage out-of a leaky roof otherwise destroyed drywall will demand is managed ahead of closing with the mortgage.

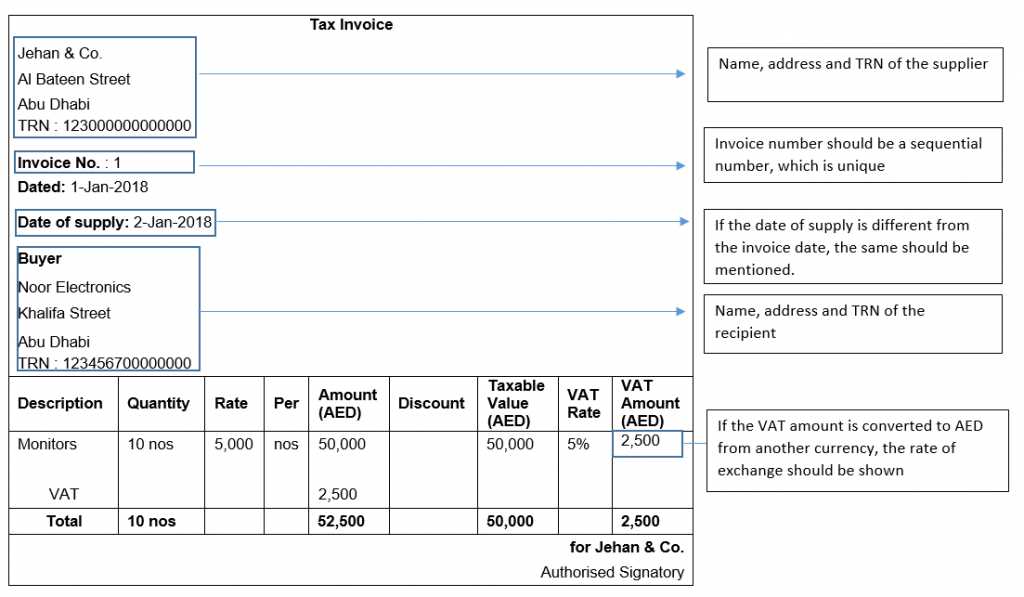

Photos could well be removed regarding damaged parts and the ones issues often should be repaired. Due to the fact supplier completes the new repairs, this new appraiser goes right back available and you can show the repairs is completed. You will find a visit payment in it that borrower must pay to have. Appraisal Situations shall be fixed. Less than is a photo out-of an appraisal that presents the house or property is in as is condition:

Appointment Local Strengthening Password Criteria

The home becoming appraised getting a different sort of https://elitecashadvance.com/payday-loans-ar/cincinnati home mortgage must meet the minimal requirements of one’s building password requirements for the individual municipality. Of several states provides certain building rules and you can appraisers will appear out for those situations. Such as, California possess particular guidelines out-of hot-water heater bands.

An appraiser must take photo of hot water tank that have the brand new straps connected. Truth be told there should also getting a carbon dioxide monoxide alarm. The loan administrator should know of every regional requirements to get in search of whenever household bing search. Anything since small once the a missing out on carbon monoxide gas detector can cause a delay regarding appraisal techniques.

What are the results When there are Assessment Activities?

A loan provider try prohibited away from ordering an extra appraisal to attain a heightened property value or straight down/cure deficiencies otherwise repairs requisite. You really have one shot with an assessment. Occasionally one or more appraisal needs, however it is strange.

A lender may only buy one minute appraisal if a keen underwriter identifies the first appraisal are materially lacking additionally the appraiser is struggling to look after brand new deficiencies. The lending company need to file the new deficiencies and then have one another appraisals within the the mortgage file. A debtor is not allowed to purchase the next assessment. It should be covered of the financial.

Assessment Procedure Alternatives

A lot of the big date when there is an appraisal procedure, the customer and you may seller need certainly to started to a damaged agreement otherwise walk away on the deal. If your appraised value is available in reduced, the financial institution may only feet their loan on appraised worth. It indicates the vendor need reduce the cost and/or buyer must pay the difference into the dollars.

Are Assessment Factors Prominent For the Homebuying Techniques?

Assessment points are part of your house to buy techniques. They actually do developed from time to time. While they are hard, new assessment techniques is very important. Gustan Cho Partners is assessment professionals.

For questions relating to the content with this blog post and you can/and other mortgage-associated subject areas, please contact us at the Gustan Cho Couples during the 800-900-8569 otherwise text message united states to own a more quickly response. Otherwise current email address united states during the We’re available seven days a week for the assessment-associated concern. Excite below are a few the Writings towards the APPRAISALS Against Inspection reports to own considerably more details.