Do you enjoy exploring the possibility of paying down your own home loan early? There is prepared a set of techniques to make it easier to repay your home financing quicker.

Why you need to pay-off your house financing less?

Owning a home is a significant milestone, nevertheless a lot of time-identity connection out-of that loan can be daunting. You can possibly cure years’ property value financial obligation by paying also a little extra in the month-to-month bond – regarding day one otherwise as quickly as possible. A number of the certain advantageous assets to paying your house mortgage more easily tend to be:

a beneficial. Preserving with the focus

Causing your lowest financial installment ensures that it can save you somewhat into interest costs. Including, if you have an R1,five hundred,000 thread over 20 years, at prime credit price of %, paying down the loan in only fifteen years can save you regarding R684, within the appeal will cost you*. So it bucks is brought towards the further opportunities or on boosting your overall economic coverage for the old-age.

b. Releasing your self out-of debt

Think of the assurance that is included with getting thread-totally free. Including efficiently purchasing quicker attract, settling your house mortgage beforehand gives you alot more financial liberty. Without any load in your home financing, you should use the new freed-up money to many other assets, advancing years discounts otherwise individual appeal (eg from there entrepreneurial think of starting your Re also/Maximum Office, maybe?).

c. Boosting your security

If you have an access bond, repaying your home mortgage rapidly happens hand-in-give that have building the collateral regarding assets and building your own budget. That it increased security are a secured item that can offer good strong foundation to own future opportunities, instance home improvements, otherwise a diminished-attract alternative to car finance.

Tricks for repaying your residence loan shorter

Claiming goodbye in order to financial obligation and having financial independence is easier when you’ve got standard measures you could just take right now. No matter if every one of these measures will bring you closer to are able to bid farewell to your residence loan just before agenda, ensure that you demand financial specialists to modify these ideas to your specific affairs:

Secure the best interest speed Initiate your house-buying travels because of the securing the essential favourable interest just at first. Look and you may evaluate lenders’ pricing to make sure you obtain the finest price in your home loan, which will help your on the very early settlement. Playing with a bond inventor such as BetterBond has proven to assist readers receive the finest contract on their mortgage. They rating estimates from all the biggest finance companies on your account, saving you time and money.

Lifetime change Thoroughly test your using designs to identify the best places to scale back. Lookup carefully at the discretionary spending: eating out, activities memberships, and you may effect looking. By creating smartly chosen options and you can prioritising debt specifications, you can redirect those coupons towards the thread installment and relieve your residence loan.

Turn your junk for the someone else’s treasure Embrace your own internal conservative and you will declutter in order to free your property away from way too many products that try gathering dirt. Never put them out, rather speak about on line opportunities and you may/otherwise offer all of them thru local thrift groups to alter your own former secrets towards dollars that one can add to their thread installment.

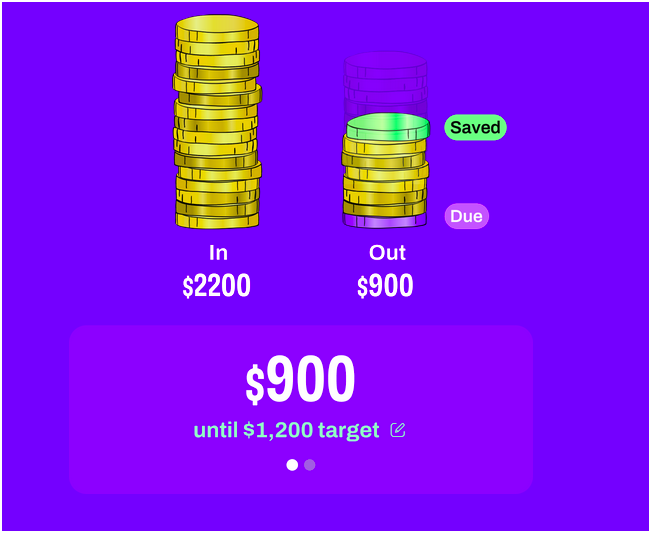

Most of the absolutely nothing extra assists All of the short, additional sum is important. As much as possible, shoot your own monthly repayments that have a supplementary amount from dedication – regardless if everything you are able to afford are a supplementary R50 it times. Such extra amounts make it possible to incrementally payday loans South Carolina chip out from the dominant loans, reducing the identity in your home loan and you may helping you to reduce notice charge.