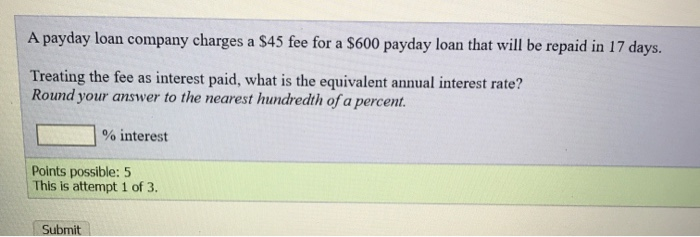

Penned

A house equity financing is that loan the spot where the borrower uses the collateral of the house once the equity on the mortgage. The worth of the house identifies the borrowed funds number.

Residential property was a valuable financial. Plus sustaining value, homeownership also provides the opportunity to fool around with guarantee for the let out of a house guarantee mortgage in order to safer reduced-cost financing when it comes to a moment financial. Another way to leverage the worth of your property is courtesy a home Equity Credit line (HELOC).

How Home Equity Performs

Household collateral money, such household guarantee outlines, use the security of your home just like the equity. Equity ‘s the difference between your mortgage obligations and market value of the house. Because loans try secured because of the guarantee of your property, a loan provider can offer lowest-rates of interest. Will, talking about very little greater than the ones from very first mortgage loans.

Our home guarantee loan creates a great lien on house one reduces the genuine security however, has the proprietor which have cash in the event that necessary. Such as for instance a great revolving way to obtain funds, exactly like credit cards, it allows one to availability the money from the will. Your house security financing is normally settled in the a lump share with a predetermined interest rate.

Things to Consider Before you apply?

As with any mortgage, you should think of the requirement before you take it. Money constantly include rates of interest, and that in the event that avoidable try a needless expenses.

However, if you have ount on the household guarantee you could evaluate other funds on various comparison portals and choose the actual top one for you. Always, they have one or two sorting choices to select from: the rate therefore the projected payment per month. Either it is possible to choose from fixed cost and adjustable costs. Anyway, its especially important is obvious throughout the whether or not your also be eligible for one of those funds.

Standards getting Family Security Financing

With regards to the financial, the requirements to own such a loan can vary. Typically, affairs just like your LTV, DTI, and credit rating was taken into account. You never know very well what people abbreviations and you can phrases mean? Dont care, we shall identify they for your requirements.

step 1. Loan-to-Really worth Proportion (LTV)

Since the name you’ll already have told you, you truly need to have a certain percentage of guarantee of your home to apply for a home equity loan. An average of, that’s from the fifteen to twenty percent. Loan providers utilize this proportion so you’re able to determine the loan-to-value ratio. This establishes if or not you be eligible for property collateral mortgage.

You can easily assess the latest LTV property value your house yourself. To achieve this, split your current mortgage harmony by projected property value the home. Such as, in case the financing balance try $100,000 and you can an enthusiastic appraiser prices the worth of your property in the $300,000, separate the balance because of the appraisal while having 0.33, otherwise 33 %. This is your LTV proportion. That have a keen LTV ratio regarding 33 per cent, you have still got 67 percent collateral of your property.

dos. Debt-to-Money Proportion (DTI)

While not all of the lenders establish earnings criteria for their home guarantee loans, of a lot tend to however consider your income to ensure that you secure enough currency to settle your loan. Nevertheless, not, best personal loans with bad credit Minnesota your debt-to-earnings proportion is yet another foundation loan providers envision when evaluating a home equity application for the loan. The low your own DTI fee, the better. All of our financial obligation-to-earnings calculator will tell you your ratio.

step 3. Credit rating

Including guarantee, there are numerous other problems that loan providers tie to creating a family security mortgage. Centered on Experian, a good credit rating regarding start around 660 and 700, such as, was a dependence on of several financial institutions in order to approve you.

Having large costs particularly one-day home home improvements, domestic guarantee money make sense. Investing renovations otherwise household upgrades to your residence will be particularly practical to you. While you perform spend some money from the loan, the worth of your house expands. Which rise in really worth, therefore, possess an optimistic affect the borrowed funds-to-worthy of proportion.

But not, capital your residence restoration enterprise that have a house equity loan features specific drawbacks, too. As your house or apartment is utilized because collateral, you chance dropping they once you cannot pay off the mortgage. While doing so, collateral fund are maybe not the answer if you only need a little cash treatment on account of highest closing costs.

Regarding, you are better off looking at old-fashioned signature loans. Read more in regards to the different pros and cons in our blog post Unsecured loans 101: What you need to Know or learn more about house restoration financing.

This information is getting educational purposes only which is not implied to provide monetary, taxation or legal advice. You really need to consult an expert for certain recommendations. Best Egg isnt guilty of all the info within 3rd-people internet sites quoted or hyperlinked in this article. Best Eggs is not guilty of, and does not promote otherwise endorse third party situations, features or any other third-group blogs.