No Credit rating? ??

Loan providers might need increased lowest downpayment from borrowers instead Canadian credit rating, will thirty-five% of one’s home’s purchase price.

Tips to getting a newbies Home loan

Whether or not you haven’t arrived in Canada but really or if you already are here, it is never too quickly or late to begin with thinking about the new immigrant home loan solutions. Understanding the steps makes it possible to prepare for your property browse and being approved having a mortgage. Here are the measures of getting a novices home loan during the Canada:

Beginning the procedure by the knowing how far you really can afford will assist you to when you start looking for property. You don’t have to be happy with a house you to definitely maxes aside what you could pay for often. Once you understand your home loan affordability lets you make an informed alternatives and you may allows you to package in the future. You can estimate your affordability that with on line hand calculators. This gives you a crude guideline as possible pursue. Additionally, you will want to initiate preserving upwards to possess a down-payment.

You should try to build your Canadian credit score before you decide you want to order a property. That is as simple as purchasing your mobile phone otherwise cable expense. Many banking institutions supply 100 % free credit cards to help you beginners which have no credit score. This allows you to definitely begin setting-up a credit score and you will strengthening your credit score.

To have a very company address from simply how much mortgage you might obtain, newcomers may prefer to rating home financing pre-approval from a financial or financial. You should understand the utmost mortgage amount your lender was happy to enable you to use, also costs while the month-to-month mortgage payment amount. You will receive a home loan pre-acceptance letter that you’ll then play with while looking for an effective household. you will understand how much down-payment try to generate to begin preserving up for it.

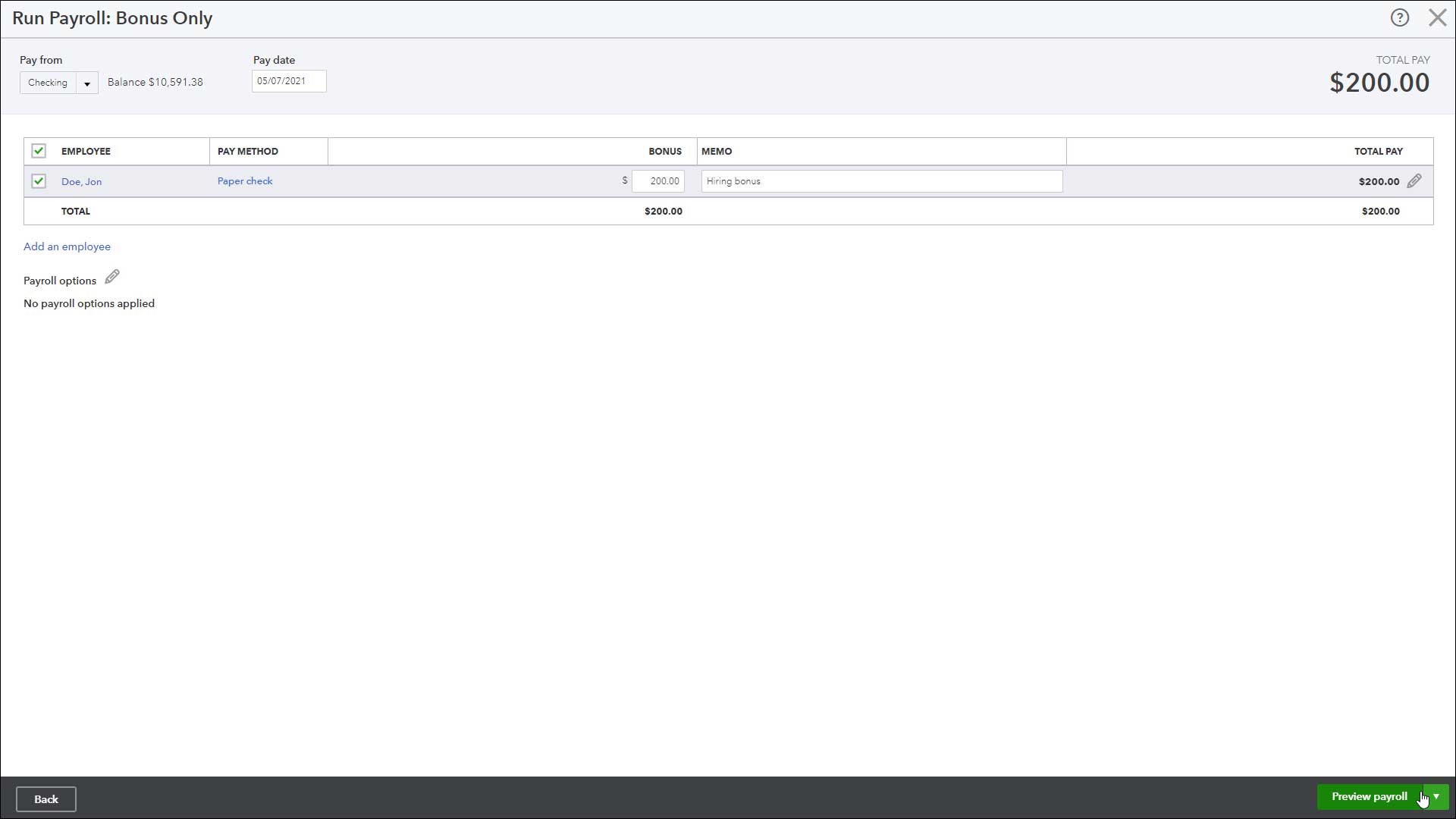

Once you have your finances manageable, it is time to look for a district real estate professional. Their real estate agent allows you to discover a property and build an offer. Once your promote could online payday loan Kentucky have been accepted, you have to be recognized to have a home loan. For folks who received a great pre-recognized financial of a bank otherwise financial, that you don’t necessarily would like to get home financing using them. You might check around along with other mortgage lenders otherwise explore a great large financial company to help you on the seek a knowledgeable price.

Home loan Standard Insurance to have Novice Mortgage loans

Home loan standard insurance policy is necessary for mortgages having a down payment out of lower than 20%. If you intend into to make an advance payment of lower than 20%, you will need to buy financial standard insurance coverage. The three mortgage insurance providers inside Canada for novice mortgage loans was CMHC, Sagen, and you can Canada Guaranty. This type of mortgage standard insurance providers most of the features more direction and you will top pricing. Your lender otherwise lending company may work with just one of these insurers, or even more than simply one to.

CMHC Newcomers

The brand new CMHC try belonging to the government and offers mortgage loan insurance coverage courtesy the CMHC Beginners program. To own long lasting residents, just be sure to possess at least credit rating of 600. When you are a permanent citizen without good Canadian credit history, the fresh new CMHC often envision choice types of credit rating, including book commission history and you can utility percentage history. For non-permanent citizens, such as those into the Canada with the a work allow, the newest CMHC use their around the globe credit file. When your worldwide credit report cannot be verified, brand new CMHC get require a research letter.