Desk out-of Contents

Homeownership is actually a key component of the American Dream. Based on a recent survey, 74% away from Us citizens believe that homeownership is very important because of their monetary stability and you will safety. Police officers have a tendency to deal with book pressures when it comes to finding homeownership the help of its requiring dates and you may constant relocations. This information provides a thorough guide to your accessing lenders having the authorities group to help you secure winning homeownership.

Financial Program Options for Law enforcement officers

Mortgage brokers to possess police can be a significant key to help you unlocking the door so you’re able to homeownership. Police officers has actually novel ventures with respect to financial support their household pick as there are numerous mortgage software one accommodate particularly on it. Such financing choices have a tendency to tend to be percentage advice about down repayments and you may all the way down interest rates, making the means of obtaining a home loan even more attainable.

One particular program was Belongings having Heroes that offers recommendations in the locating mortgages created specifically for police professionals. That it organization provides hitched having lenders all over the country to ensure eligible individuals can benefit from reduced fees or any other bonuses related with the formal affairs. Concurrently, House getting Heroes even offers information such as academic information with the economic literacy and you can help properties related to homeownership.

The combination off special mortgage software accessible to police officers alongside devoted groups providing financing recommendations brings a comprehensive program out-of systems and info that enable the police teams to pursue owning an effective house. From this the means to access certain choice and educated guidance, the authorities workers are considering a greater window of opportunity for achieving effective homeownership.

Home town Heroes Aids in The authorities Mortgage loans

Home town Heroes try an organisation that focuses primarily on providing the authorities officials acquire lenders having affordable rates and you can terms. They offer advice instance 100 % free borrowing counseling, loan prequalification services, and you may use of pros eg no closing costs or charge to the certain home loan points. As well, they mate having HUD’s Good neighbor Next-door system which gives an effective fifty% dismiss off of the price of qualified belongings based in portion focused to own revitalization by local governments. This method facilitate police get their fantasy home with no to hold any money out of pocket; as an alternative which makes it easier so they are able get access to homeownership through effortless money choice. By utilizing all tips offered by each other groups, law enforcement officers can achieve their purpose of buying a home on a reduced costs compared to old-fashioned actions.

Hud Good neighbor Nearby

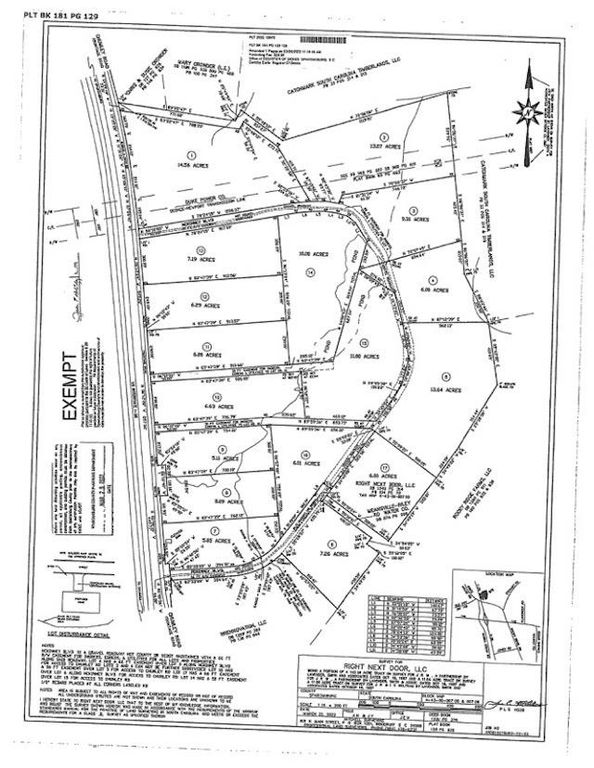

The newest HUD Good neighbor Next door (GNND) system also offers a special window of opportunity for the authorities personnel to become people. Which initiative provides discount home pick cost in order to very first responders, including law enforcement officers or other public service professionals. In GNND system, eligible people can also be located fifty% off the list price of house located in stimulating neighborhoods or rural areas along side United states.

To-be qualified to receive that it guidelines, candidates need certainly to satisfy particular standards related to their occupation as well as the income peak and you will household requirements. At the same time, they need to commit to surviving in the new purchased property to have within minimum 3 years immediately after closing on their financing. During their tenure throughout these dwellings, users are required so you can lead on stimulating teams by making necessary repairs and improvements that work with regional owners.

The newest GNND program gift ideas an excellent way to own the authorities gurus in order to safe sensible casing choice while you are helping the communities with pride. That have accessibility less will set you back from this render, borrowers may find it better to do down costs and monthly home loan repayments than simply perform or even end up being you can easily in place of assistance from government software including GNND. From this help, very first responders renders advances to your achieving a lot of time-name homeownership goals easier than in the past. By firmly taking benefit of so it bonus, these folks provides http://clickcashadvance.com/installment-loans-mn/victoria/ a superb road discover before them in the pursuit of becoming winning people.