Regarding settling a home loan, these suggestions makes it possible to score debt-100 % free less

For many individuals, a mortgage is the prominent resource they are going to generate inside their life-and paying down the enormous loan might be equally as daunting. Listed here are 10 an effective way to reduce your mortgage punctual, saving you toward fret and you can attract.

Get a hold of a home loan that suits your needs

When choosing a home loan, it is far from constantly just regarding the rates; rather, choose one you to best meets your needs and you will caters to your aims and you will life. Lenders with a counterbalance membership, for example, you will definitely provide with these people large rates than other items but you are going to help you save more income finally of the offsetting financing on your deal membership up against the mortgage.

Be careful to your providing introductory prices

In early stages, most lenders can offer attractive introductory rates, switching to a higher changeable interest rate after the first months concludes, typically before long. It is very important be looking for those introductory costs because the varying rate have a tendency to dictate your payments for approximately the next 3 decades. Concurrently, you happen to be obligated to shell out heavy get off charges if you change to a diminished rate where fixed-speed period.

Pay most costs

That old cure for decrease your mortgage timely try to expend most, while able, also the month-to-month cost. Usually, lenders makes it possible to generate bi-per week otherwise per week costs rather than month-to-month payments, and since , really mortgage loans provided don’t costs for payment punishment. Rather than only within the attention, extra click here to investigate money wade for the paying the primary, decreasing the count you owe. Typically, youre billed smaller appeal for many who owe reduced principal.

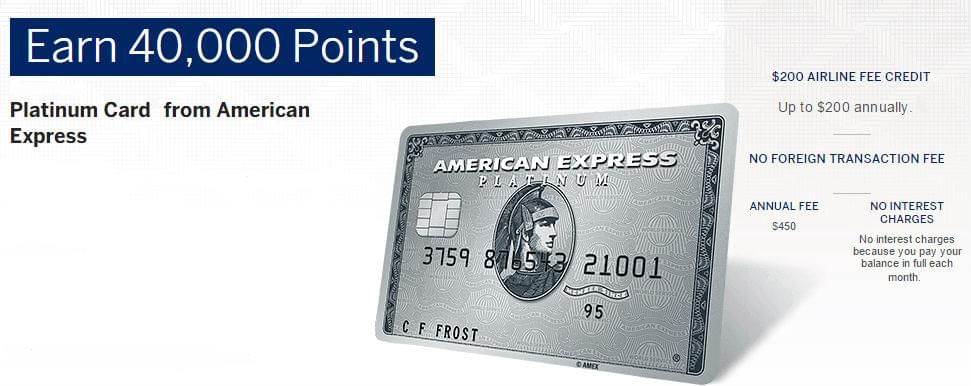

Require economic bundles off bank

It is common to ask for solution economic packages of lenders, together with fee-totally free playing cards, discounted home insurance, a charge-100 % free transaction membership, or 100 % free meetings which have monetary advisers. While some of those even offers may appear for example brief potatoes when you are purchasing in your mortgage, every protecting counts.

Thought combining your financial situation

Ascending interest levels dont only effect your property loan-you could find the brand new cost to your types of borrowing from the bank such auto loans, unsecured loans, or playing cards increase as well. That may create difficult to remain on greatest of all the the individuals bills.

Should this happen to you, you might imagine combining your debts towards just one streamlined cost. Doing this will be especially of use because the rates on borrowing from the bank cards and personal financing can be very a little while greater than your home financing rate. But make sure to double-determine in the event the cracking established financing deals costs from inside the log off charges. Debt consolidating isn’t necessarily the lowest priced option.

Contemplate using a counterbalance membership

This will be an effective transactional bank account associated with your house loan. The bill of your own counterbalance account is sometimes deducted on dominant amount possessing in the event that attract on the mortgage was calculated, reducing the desire you are recharged and you may helping you to spend regarding your own focus and you will principal mortgage easier.

Refinance to a shorter term

In order to potentially slash many years out-of the loan and help save into the appeal charge, you can envision seeking a new financial with all the way down cost-but earliest definitely determine the cost of altering finance. Also possible place fees to alter to a new mortgage, you can be on this new link getting expensive hop out charges payable on your newest financing.

One way to create a supplementary homeloan payment yearly try to cut out your less crucial costs, that sound right notably year round. It’s also possible to ensure you keep track of your property attributes because of the comparing your internet company, fuel and you may electricity, and also from the deciding on health insurance coverage. This will help you find out where to make slices so you can your own expenditures that you can next explore because that extra financial payment.

Yet another method that’ll help you here’s easy yet effective: provided bi-weekly costs instead of monthly payments. Because there are 26 fortnights a-year and simply 1 year, you create the equivalent of 13 monthly premiums. This may processor out during the appeal and also the prominent.

Decrease your harmony which have a swelling-sum payment

If you have attained an enormous bonus or payment cheques, passed on money, otherwise sold another type of assets, you could potentially then implement the fresh new continues towards the prominent equilibrium. Lump-contribution costs will be the second ideal thing in the event of Virtual assistant and FHA financing, which can not be recast. You will need to identify if extra cash will be put into the main with a few mortgage servicers. In the event that’s false, you can broke up the additional currency amongst the principal in addition to desire, due to the fact its separated during the monthly home loan repayments.

Is actually home loan recasting

As you maintain your existing loan, mortgage recasting differs from refinancing a mortgage. To own financial recasting, the bank will to alter the benefits agenda to echo the new harmony after you have paid a lump sum payment toward the main, leading to a shorter-identity mortgage. The latest fees is down when recasting-a major work for. In contrast: recasting fees usually work with just a few hundred bucks when you find yourself refinancing fees can run-in new plenty.