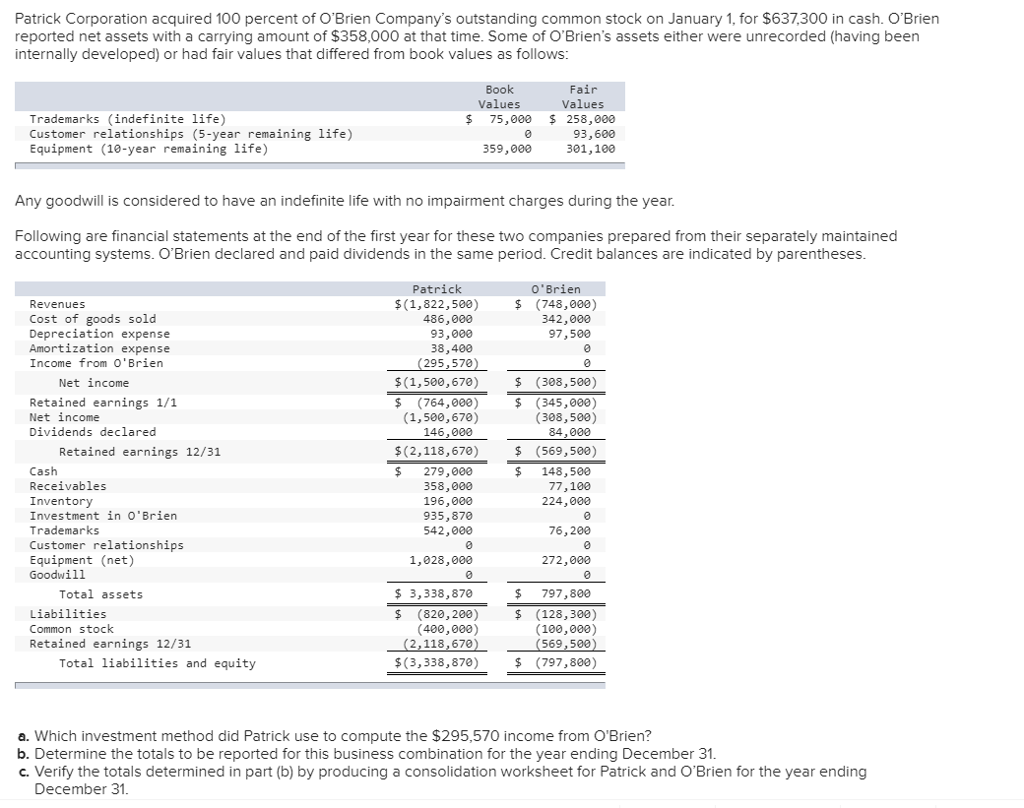

Purchasing property is a huge decision made up of multiple less conclusion, instance the best place to pick, and that mortgage company https://paydayloancolorado.net/new-castle/ to utilize and exactly how much youre willing to expend on your house . However, probably one of the most extremely important behavior you’ll be able to build is when huge from an advance payment to put upon your house.

If you find yourself conventional expertise states that it’s wise to establish 20% of your residence’s really worth, this isn’t constantly the proper move. The amount of your own deposit are certain to get multiple bubble effects, regardless if, it is therefore important to take a moment while making an informed decision exactly how far currency to get off.

There are a lot of you should make sure when deciding exactly how much currency to place down on a house get. Here are a few of the things to remember as you build your decision.

Thought how much money you have

It could be appealing to spend all the money in your bank account to make the biggest you can easily down payment – or perhaps get to you to definitely 20% – but that may leave you inside an adverse reputation along side long term.

You usually want to have some money around for issues. That could suggest an enormous medical statement, unforeseen auto resolve otherwise work that have to be done on our home youre to purchase. Purchasing a house is very good, however you nevertheless you need bucks to work alongside to have daily life. Therefore, the first thing to believe whenever choosing the size of off good downpayment and work out is when far you can afford.

Having said that, discover positive points to and make increased down payment. Specifically, after you set more cash down up front, you can easily pay shorter 30 days and less attention total.

Let’s say you are to shop for a home having $600,000, using a thirty-seasons repaired-rate mortgage within the current federal average interest away from 7.09%. If you make an excellent 20% advance payment totaling $120,000 their payment per month may come in order to $step three,683. Regarding loan identity, you are going to shell out $680,563 for the desire having a total mortgage price of $1,160,563.

Today let’s glance at the same financing that have a beneficial 10% deposit regarding $sixty,000. In cases like this, you’ll pay $4,086 four weeks. For the whole mortgage, possible shell out $765,412 during the attention for an entire loan price of $step 1,305,412.

Paying 20% have almost every other experts

And you will, there are more advantages to getting off 20% on your household. A person is that in case you can 20%, you usually won’t have to get individual mortgage insurance rates (PMI) . PMI is usually necessary for lenders to the finance where in actuality the buyer put less than 20% upon our home. PMI can be equivalent to ranging from 0.2% and you will dos.0% of your own total mortgage annually, but the actual rates hinges on factors just like your bank, place, mortgage info and you will credit history .

Their financial price issues, as well

A unique grounds to look at when determining how much money to put down on you reside the mortgage speed you’re getting. Immediately, home loan rates was highest just like the listed over, the latest national mediocre into a thirty-seasons fixed-price financial is more than seven%. Whenever costs are in so it assortment, it’s a good idea to place as much currency down you could, as the over thirty years, the focus can truly add up.

When you are to purchase a house immediately when financial costs was down, it could seem sensible and work out a smaller down payment and you may invest the currency it will save you.

The bottom line

Going for how much money to put down on an alternate domestic pertains to multiple items. To start with, you really need to think how much money you might rationally afford to put down. Opt for how much cash you can pay month-to-month with different down-payment totals, rates additionally the advantages you’d get by hitting the 20% number.