“All of our value proposal most came right down to that phrase, which is, we would like to end up being noted for price and you can provider having fun with digital products and technology,” told you Sorochinsky, that is lead of financial lending toward $a dozen.step 1 mil-house DCU.

DCU technically launched the brand new self-services mortgage webpage inside 2022 once spending per year piloting the new program so you’re able to optimize the fresh techniques. The fresh new digital lending platform, created of the Nj software corporation Blue Sage Selection, capitalizes for the credit union’s “individual head” model by permitting potential borrowers to apply for mortgages and you can home guarantee finance and you will re-finance current funds, without the need for a personnel.

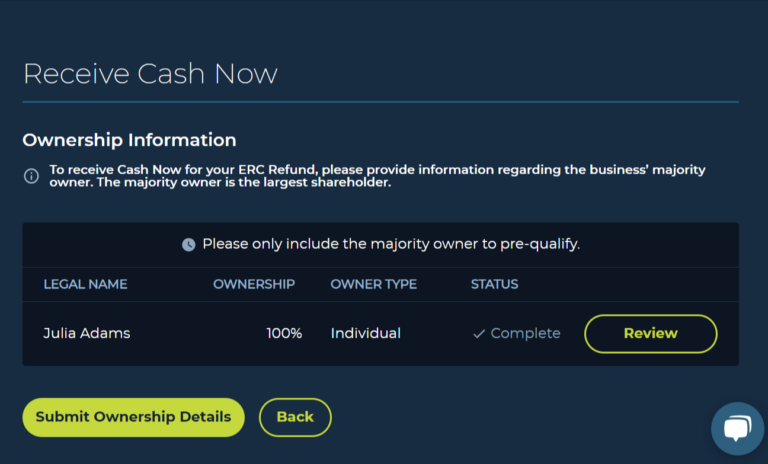

Immediately after finding and that of your own three situations they would like to apply to possess, and inputting possessions information particularly area code, expected down payment and you will projected cost, people can see the most they could bid on the a beneficial property and choose and therefore prices and you may terms greatest complement their demands. It phase also allows participants to digitally guarantee their money, a position and other possessed possessions to help with their qualification.

When you look at the software processes, individuals concerned about sector volatility can be lock in its rates having fun with OptimalBlue’s rates lock API, to own 15 in order to 90 days.

A secondary API experience of everything attributes company ClosingCorp brings extra assistance because of the calculating application and assessment costs together with generating revelation arrangements to your member so you’re able to sign.

Participants are certain to get characters or sms compelling them to just do it to the next stages in DCU’s mortgage site and signal the new called for forms following initially software is registered. While the fees is repaid, commands are positioned set for practical points including identity insurance coverage, appraisals and you may flooding certificates, next a moment round away from verification data files is actually repaid in order to the newest applicant getting finalizing.

Once finalizing every needed models, the latest file is actually published to the newest underwriting agency for additional handling – and therefore DCU claims you can do within 30 moments and you may without needing a cards union member. Two-ways correspondence having a beneficial DCU home loan lending officer, processor otherwise closer via a talk means, in addition to informative videos, are around for help the representative target any affairs.

“Regardless of what the new forces try, credit crunch otherwise high costs otherwise reasonable inventory, we can easily nevertheless be successful due to the fact we have been emphasizing rates and you will provider having fun with digital products and you can tech,” Sorochinsky told you. Adding the new mind-services portal, DCU were able to improve credit out of more or less $step 1 mil inside the mortgage loans when conversations began during the 2019, so you’re able to $step 1.six billion for the 2023.

DCU is one of a number of most other institutions having added the newest innovation regarding the hopes of promoting subscription growth and you will expanding financing regularity.

, for example, been able to build key subscription of the twenty two% and you will increase dumps by more $five hundred million during the a half a dozen-month period by using brand new York-founded account starting fintech MANTL’s put origination system. The Providence, Rhode Area-centered

Whenever Jason Sorochinsky first started converting this new Marlborough, Massachusetts-situated Digital Government Borrowing from the bank Union’s home loan origination processes from inside the 2019, the guy knew that always providing the low cost was not feasible

as the signaled rates reduces will provide treatment for lower financial cost – spurring newest borrowers so you can re-finance to possess a far more beneficial level.

“Now, individuals remember that a home is a fantastic money [as] it includes all of them this new freedom which will make the home of their dreams, make use of taxation advantages and create money throughout the years,” Shultz said. “The chance to re-finance its financing toward a lower price in the following step one-couple of years is actually an actuality.”

Positives that have Cornerstone Advisors and you can Datos payday loans in Homewood AL without bank account Wisdom underscored the necessity of correct homework when vetting one another third-group agencies while the facts it provide this new dining table, however, similarly highlighted the worth of investigating the brand new technical.

“That it feels like a no-brainer but even with program possibilities, of several underwriters however by hand pull credit and you can calculate ratios manually,” said Eric Weikart, mate at the Foundation Advisors. “Often, it is because system setup activities but some minutes its as they have always done they that way and additionally they aren’t prepared to transform.”

2nd, DCU will use Bluish Sage’s consolidation for the mortgage fintech Maximum Blue’s device and you may rates system to allow people to check on and you can pick the popular blend of loan terminology and you can prices

Automation is a vital feature for underwriting software is its effective, however, just with “comprehensive exposure evaluation, regulating conformity and you will obvious recommendations” as well as applied, told you Stewart Watterson, proper advisor for Datos Skills.

“As compared to 20 or three decades in the past, consumers have a much large expectation from rate so you can recognition and closure plus desire to have an innovation allowed process supported by knowledgeable, elite group mortgage officers and processes team,” told you Christy Soukhamneut, chief credit manager toward $cuatro billion-house School Federal Credit Commitment within the Austin. “We’re earnestly applying home loan technology that is simple to use and you will easy to use to ensure all of our conversion process teams can also be focus on the user and you may referral lover feel.”