You’ll qualify for a home loan when you can generate regular earnings, whether functioning otherwise self-working. Once the a self-functioning borrower, indicating that you have an established source of loans would be one particular important preparing.

Financial statements and you may taxation statements are a handful of popular a means to establish your secure economic avenues. It is important to make sure that you might confirm their earnings which have good paperwork.

Help make your money background available

Extremely financial companies wish to see your income record having at the very least for the past year. For this advice, lenders will most likely comment their income tax come back.

Improve your way of ensure you possess a taxation return that reveals a powerful net income, particularly if you come into the fresh habit of playing with a great deal from create-offs.

Financial statements is actually another way to prove your own monetary resource. Lenders constantly inquire about to 24 months’ worth of lender comments to help you calculate the mediocre monthly money. It is based on places converted to your money.

Make a huge down-payment

Loan providers essentially view you due to the fact less of a risk for folks who create a big advance payment because the in that way https://simplycashadvance.net/loans/same-day-personal-loans/, there are less debt to settle. Your own month-to-month mortgage payments would-be all the way down, and you can reduce money borrowed if you default. That have a down-payment more than 20% may also save you off spending individual mortgage insurance.

Not only will a large deposit make it easier for one be eligible for home financing, but it may make you accessibility top terms such as for instance lower interest rates.

Prepare yourself your monetary records

The borrowed funds top-notch you are coping with will let you see and that monetary data you should render. Even though it may differ, lender comments and tax statements try really expected. Verify that you really have those in helpful. If not, get them as soon as possible.

As worry about-employed homeowners tend to have more difficult types of earnings, they have to search greater. Connecting their accountant along with your bank is a sure way of performing it or bringing a whole lot more proof of earnings.

Try to help save

This isn’t a requirement however, protecting large helps you once you get a home loan. When the nothing else, it can give you far more alternatives such decreasing the count of loans you’re taking into the by making a massive down payment.

How do i let you know care about-working money to own a home loan?

To display notice-functioning income for home financing, you should render a track record of uninterrupted self-employment money for around a couple of years. Really financial finance companies otherwise businesses will look for the next:

A position confirmation

A position verification will assist you to illustrate that you was mind-functioning. The easiest way to get a career verification would be to let you know letters otherwise emails because of these provide:

- newest customers

- licensed certified private accountant

- elite organizations that can make sure your registration

- Conducting business Because (DBA)

- insurance for your business

- any business or county license you keep

Income paperwork

You are a stride closer to delivering accepted getting good mortgage when you yourself have income papers. Most loan providers ask for such data:

- individual taxation statements

- profit-and-loss comments

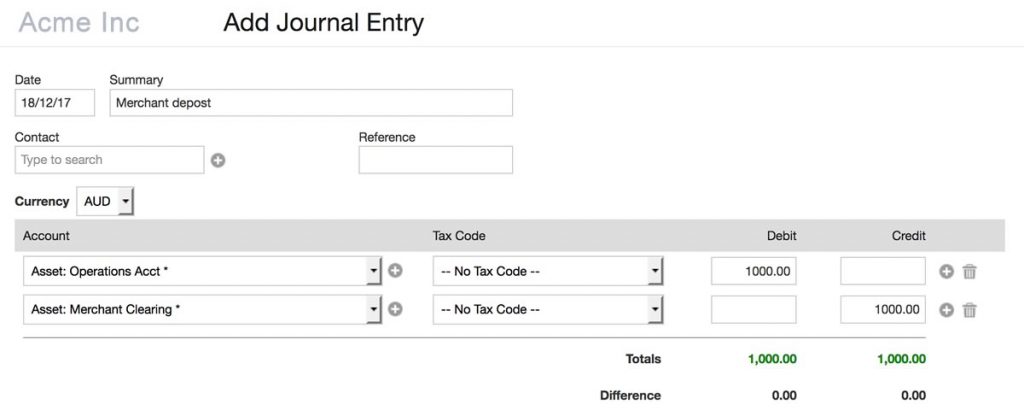

- financial comments

Could it be better to be reproduced otherwise thinking-utilized for home financing?

Off a home loan lender’s direction, its more straightforward to influence your financial standing if you find yourself working as opposed to self-working. Here is a quick post on working individuals and notice-employed individuals:

Functioning home loan

An used debtor usually has a contracted income with their company and is without difficulty able to produce a job confirmation and earnings records. Lenders use this information to choose simply how much money the fresh new debtor must make to settle its mortgage.