To find a property is one of the most tall expenditures you renders. For the majority of homeowners, you to large out of a purchase demands capital in the form of a home loan. However when you have made your purchase, your own home loan repayments begin working to you personally because you build equity of your home. Home security is leveraged if you take away a house equity financing, also known as a moment financial.

These monetary equipment have become comparable, but you can find variations, especially in installment words. Let us find out the similarities and you will variations.

Secret Takeaways

- Household guarantee money and mortgage loans both play with property since the collateral having a guaranteed mortgage.

- House equity loans are usually fixed interest rates over a length of five to thirty years.

- Mortgage loans can be repaired cost or adjustable costs.

What is actually home financing?

Home financing try a repayment loan accustomed buy a house. There are a few different types of mortgage loans, and additionally conventional funds supported by financial institutions, and financing supported by the brand new Government Property Management (FHA), the brand new You.S. Company out-of Veterans Issues (VA), and also the You.S. Institution out of Farming (USDA).

Mortgage loans may have either fixed rates otherwise variable cost. Adjustable-speed mortgage loans (ARMs) to improve their rates on an appartment plan. Such as for instance, a beneficial 5/step 1 Sleeve also provides a fixed rates to your first 5 years. Then, the interest rate tend to to change yearly through to the financing try paid down. There are numerous types of Possession, so make sure you comprehend the regards to their arrangement.

Alerting

You truly need to have at least 20% security in your home is recognized to possess property security financing. When you yourself have an appeal-just financing, the first several years may not make any equity so you can borrow against subsequently. Collateral can still be based of the enhancing the value of your own home, either as a consequence of advancements or field way.

What is a property Guarantee Mortgage?

Property equity mortgage try a loan secured by the equity manufactured in your property, both by simply making home loan repayments otherwise because of the increasing the property value your house. Family security money are usually entitled 2nd mortgages while they function in a really comparable method. They are both fees finance safeguarded because of the possessions, along with case out of nonpayment, the lender commonly seize the house to settle the mortgage.

In place of a home loan, property guarantee loan try given out inside a lump sum of cash. The funds can then be used to pay for one thing. Some typically common spends try having renovations, repaying higher-focus personal debt, otherwise capital a vacation, matrimony, or degree.

Exactly how Try Domestic Guarantee Money and you can Mortgage loans Comparable?

Each other home collateral financing and mortgages are paid back towards a predetermined schedule. The preferred installment episodes getting mortgages is 15 and 29 years, however lenders provide ten- and you may 20-year terms also.

Home guarantee fund vary from five to thirty years away from fixed payments. It’s pretty unusual to track down adjustable-rate household equity money.

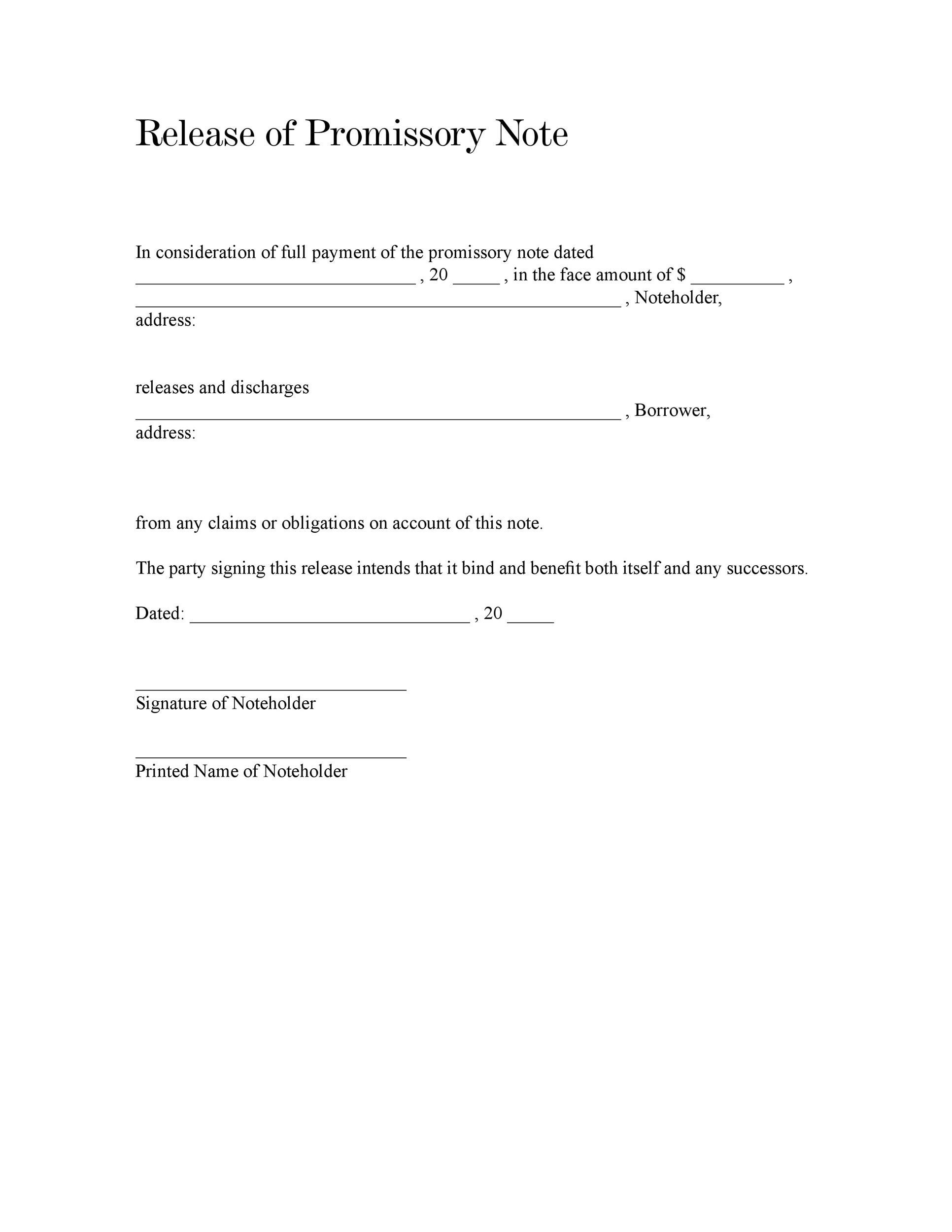

Both style of financing may also incur closing costs for example appraisals, file costs, notary fees, and you will origination costs. Specific lenders will waive some costs getting family guarantee funds to help you succeed more appealing having individuals.

Exactly how Are Family Equity Finance and you will Mortgages Some other?

While household collateral loans and mortgages are very equivalent, there are key differences. The very first is on the interest. Household collateral money tend to have a somewhat higher interest than just a primary financial. Due to the fact home collateral funds are considered 2nd mortgages, if you’re unable to make your payments, your house could go toward foreclosures to satisfy the debt. When your financial deal your house, it does utilize the continues to blow the key mortgage very first following fool around with people excessively to invest the home collateral loan. Since the a safeguard, it charges a whole lot more notice to counterbalance any potential losings.

There is also more kind of payment agreements having mortgages. Although the most common percentage identity relates to payments that come with currency for the your own dominating and you can attract, there are even appeal-simply finance. Interest-only loans was arranged given that Arms, and borrowers pay just focus to possess a-flat time period just before money transition to your more traditional dominating and you will focus structure.

Beware of desire-simply money while wanting strengthening collateral to have the next home collateral loan. In the attract-only months, they do not build guarantee.

Ought i Enjoys property Collateral Financing in the event that My personal Mortgage Is actually Paid down?

Yes. A house guarantee loan is based simply on your own collateral, not if or not you may have a home loan. For many who individual your house outright, you’ve got 100% security. That said, you are however simply for credit Nevada payday loans only 80% of your own house’s guarantee.

Simply how much Guarantee Manage I wanted to possess property Collateral Loan?

Lenders choose that you have at the least 20% collateral of your home in order to you property security mortgage. You could build guarantee by both while making costs otherwise improving the worth of your residence. In case the housing industry increases, that can also increase your own guarantee.

Is there a minimum Amount You can Borrow secured on a home Security Loan?

This will vary from lender to lender, but the majority loan providers love to put at least amount borrowed out-of $ten,000. Since the house equity financing usually cover settlement costs and you will costs for appraisals, it makes sense in order for the quantity your obtain is actually really worth the charges. When you need to make use of your family security to possess an inferior mortgage or anticipate demanding short sums throughout the years, you can believe a property security line of credit (HELOC) alternatively.

The conclusion

Mortgage loans and you will house guarantee funds have very comparable installment terms and conditions. Be cautious about varying-rates mortgage loans (ARMs)-their will set you back could possibly get vary into the erratic areas, whenever you choose an interest-merely mortgage, you can also overlook rewarding guarantee-strengthening day. Family equity funds bring self-reliance having huge requests and will getting realized into the monthly funds in the same manner that mortgage really does. Favor an expression and percentage that meets your allowance to eliminate defaulting on the requirements and shedding your house.