The fresh new Federal Homes Management (FHA), that’s area of the Department off Casing and you may Metropolitan Creativity (HUD), administers some unmarried-family relations mortgage insurance policies software. These types of apps efforts compliment of FHA-accepted financing establishments and that submit software to obtain the property appraised and also have the client’s credit acknowledged. HUD cannot build direct financing to help individuals get land. The new Point 203(k) Program was HUD’s pri towards the rehabilitation and you can repair out-of solitary- friends functions. As such, it is a significant device getting society and you can neighborhood revitalization and you may to have increasing homeownership ventures. Mainly because would be the first requires out of HUD, they thinks you to definitely Section 203(k) is an important program and intends to always firmly service the application form while the loan providers one to participate in it.

Of many loan providers features properly utilized the Part 203(k) Program together with state and local construction firms and you may nonprofit communities to help you rehabilitate functions. These businesses, including state and you can local government businesses, discovered a means to blend Area 203(k) with other financial resources, such HUD’s Home, Vow, and you may Area Invention Stop Grant Applications, to greatly help consumers. Numerous condition homes funds businesses enjoys tailored apps particularly for have fun with that have Area 203(k), and some loan providers have also used the expertise off regional houses businesses and you will nonprofit teams to greatly help create brand new rehab handling. HUD along with believes that the Point 203(k) System is an excellent method for loan providers to exhibit their partnership so you’re able to credit inside lower-money communities and to let fulfill their duties in Neighborhood Reinvestment Act (CRA). HUD is actually committed to increasing homeownership ventures to possess household during these organizations and you may Point 203(k) is a superb device for use having CRA-types of financing applications. When you yourself have questions about the new 203(k) System otherwise have an interest in bringing an effective 203(k)- covered real estate loan, i suggest that you contact an enthusiastic FHA-acknowledged lender close by or the homeownership cardio on your urban area.

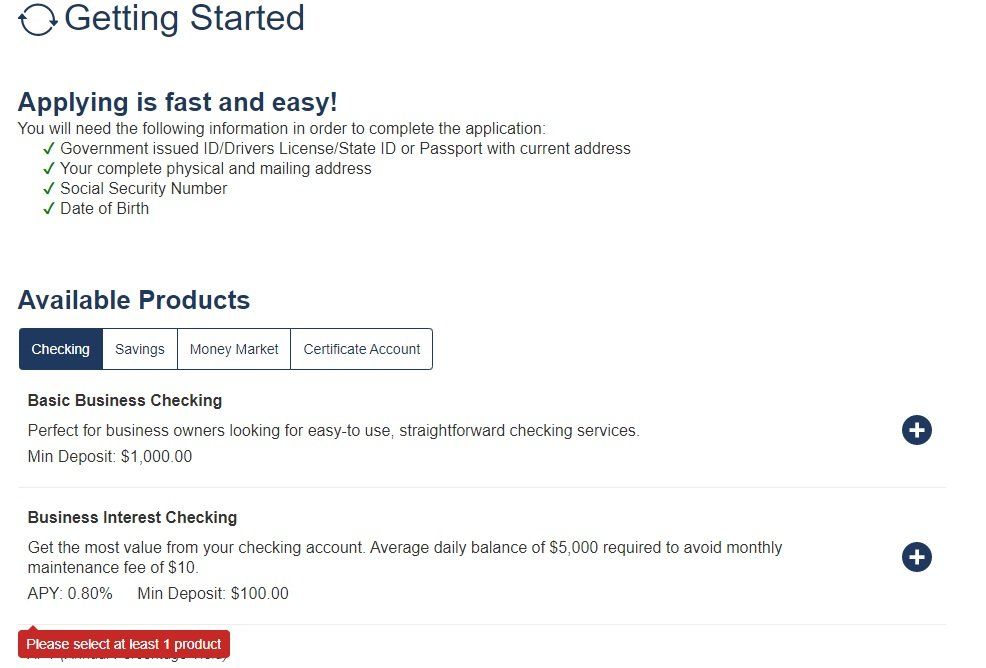

In the event that loan is actually closed, the fresh new continues designated on rehab or improvement, such as the contingency set aside, can be placed in an interest-bearing escrow membership insured by the Government Put Insurance Firm (FDIC) or even the Federal Credit Partnership Management (NCUA)

Most financial money plans promote only long lasting resource. That’s, the lending company does not constantly close the loan and launch the new mortgage proceeds until the problem and cost of the home bring sufficient mortgage shelter. When rehabilitation is in it, consequently a lender usually requires the advancements become finished prior to a lengthy-identity financial is established. When a home customer really wants to pick a house in need of assistance away from fix or adaptation, he or she usually has discover resource earliest to get the dwelling, even more resource to do the newest treatment framework, and you can a long-term home loan if the tasks are done to spend off the meantime money. Often, this new meantime financing (the purchase and you may construction funds) comes to seemingly highest rates of interest and small amortization symptoms. The brand new Point 203(k) System was designed to address this case. Brand new borrower get a single mortgage loan, at the an extended-name fixed (otherwise changeable) rates, to invest in both the purchase together with rehabilitation of the home. To add financing into the rehabilitation, the borrowed funds matter is dependent on new projected worth of the brand new property to your works accomplished, taking into consideration the cost of the task. To attenuate the chance on the home loan company, the mortgage mortgage (the maximum deductible number) is eligible for endorsement from the HUD once the home loan proceeds was paid and you will a treatment escrow account is generated. To date, the lending company possess a fully-covered mortgage.

Yet not, the lender get influence that an as-was appraisal is not possible otherwise called for

- weather-remove all the doors and windows to attenuate infiltration of air whenever established weatherstripping was ineffective or nonexistent;

- caulk and secure the spaces, cracks and you will bones about building package to reduce sky infiltration;

- insulate all of the opportunities in exterior structure in which the cavity might have been unwrapped considering the treatment, and you may protect threshold places where requisite; and you will

- adequately ventilate attic and you will crawlspace areas. For additional information and needs, reference 24 CFR Area 39.

However, the lender could possibly get dictate you to definitely a concerning-is appraisal is not feasible or needed

- temperature loans Redland AL, ventilating, and you may air-conditioning system also have and you may get back water pipes and you may ducts should be insulated when they tell you unconditioned places; and you may

- heat systems, burners, and you can sky-strengthening systems have to be carefully measurements of are no more than 15% large on the critical design, heating or air conditioning, except in order to satisfy the new maker’s next closest moderate dimensions.

A good. as-is really worth: A different assessment (Uniform Domestic Appraisal Statement) may be required to select the as the-is worthy of. In cases like this, the lender can use brand new deal conversion rate into the a buy transaction, or the established loans on the a good re-finance deal, because due to the fact-is really worth, if this doesn’t go beyond a reasonable guess of value.

B. worth after treatment: The brand new asked market price of the home is determined upon achievement of your advised rehab and you can/otherwise developments.

So it account isnt an escrow to have spending home fees, insurance costs, delinquent notes, soil rents or examination, that’s never to be addressed as such. The web income obtained by the Rehabilitation Escrow Membership need to be paid off to the mortgagor. The process of these commission was at the mercy of agreement ranging from mortgagor and mortgagee. The lending company (or their agent) usually release escrowed funds through to achievement of your own advised rehabilitation when you look at the conformity with the Really works Create-Up and new Draw Consult (Means HUD-9746,A).

Inspections should be did from the HUD-recognized payment inspectors or to the HUD-approved group of your De financial. The price tag inspector is to apply the brand new architectural displays in check while making a choice off compliance otherwise non-conformity. If the inspection is scheduled with a cost, the brand new inspector would be to imply perhaps the functions has actually come complete. Also, the fresh inspector is to use the new Mark Request Mode (Form HUD-9746-A). The first draw must not be planned till the bank provides figured new relevant building permits was basically approved.